- Login

10.01.2023

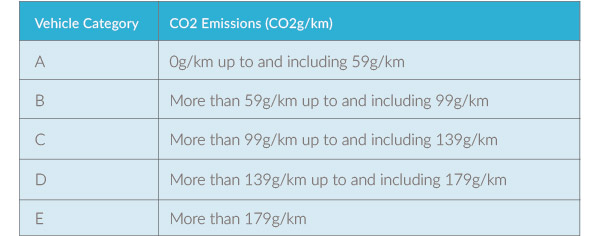

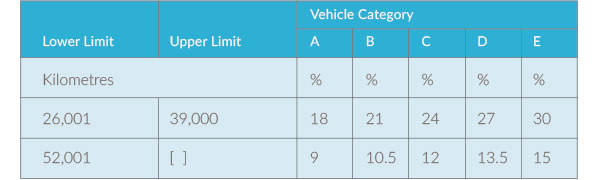

From Jan 2023 Benefit In Kind (BIK) percentages will be dependent on CO2 emissions as well as mileage.

Employees provided with a company car that they also use for private mileage are liable to pay tax on the Benefit In Kind – known as Notional Pay.

The new rules mean that Benefit In Kind amounts are now determined by the vehicle’s CO2 emissions as well as business mileage as per below.

Our Miles Monitor fleet management solution offers numerous benefits including:

Contact our dedicated account team today on +353 1 903 9443 or priority@silveyfleet.com to find out more.

© 2022 Valero Energy (Ireland) Limited. All rights reserved. TEXACO and the STAR T Logo are registered trademarks owned by Chevron Intellectual Property LLC. Used with permission. All other trademarks are the property of their respective owners, and are used with permission.